Starting a business, getting a visa, or opening a bank account in the UAE? Explore our FAQs for clear insights on company setup, taxation, and compliance. Learn how to navigate regulations smoothly, maximize your benefits, and connect with our experts anytime for tailored guidance and support.

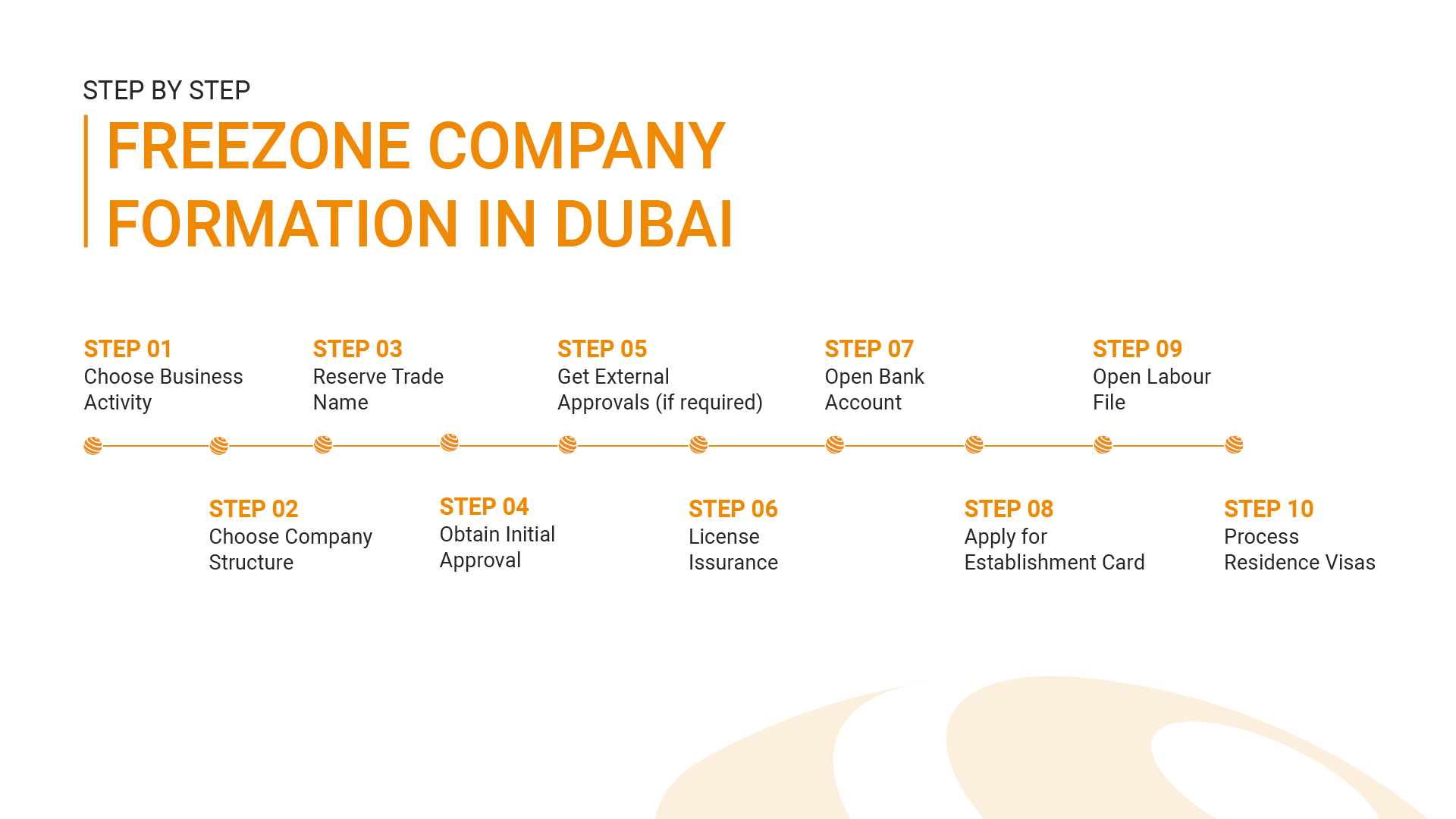

Free Zone Company Formation in the UAE

Free Zones are designated economic areas that offer businesses preferential tax, customs, and regulatory benefits. Established to attract international investment and promote economic diversification, they provide a business-friendly environment, including full foreign ownership and streamlined setup procedures. The UAE is home to over 50 Free Zones—some cater to all industries, while others are sector-specific.